Five Year Sentence For Former Morgan Stanley Broker James Polese

In September, we told you about Morgan Stanley brokers James Polese and 29-year-old Cornelius Peterson, who were found guilty of financial charges ranging from conspiracy to aggravated identity theft. They have both been sentenced in the case.

James Polese has been sentenced to 60 months (five years) in prison after pleading guilty to one count of conspiracy, one count of investment adviser fraud and eight counts of bank fraud as well as a charge of aggravated identity theft. The government originally requested 75 months, and the federal guidelines indicate a minimum sentence of 87 months. Polese’s attorney argued for a shorter sentence of 40 months.

James Polese has been sentenced to 60 months (five years) in prison after pleading guilty to one count of conspiracy, one count of investment adviser fraud and eight counts of bank fraud as well as a charge of aggravated identity theft. The government originally requested 75 months, and the federal guidelines indicate a minimum sentence of 87 months. Polese’s attorney argued for a shorter sentence of 40 months.

Polese was ordered to pay $462,000 in restitution plus a $30,000 fine. After his release from prison, he will be supervised for three years. He will be restricted from working in financial services, and prohibited from drinking alcohol beyond a blood alcohol content (BAC) of 0.10. The judge recognized Polese’s work towards rehabilitation, which included speaking with two ministers who offered letters of support.

Securities Arbitration Lawyers Blog

Securities Arbitration Lawyers Blog

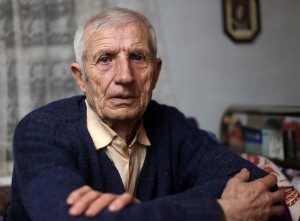

Based on FINRA’s BrokerCheck report on Peterson, a complaint was filed on September 1, 2017 alleging that Peterson provided misleading information to investor clients during his employment at Morgan Stanley Smith Barney. In 2016, Peterson and his colleague James S. Polese were both charged with allegations relating to stealing upwards of $450,000 from one of their elderly clients. The allegations include misappropriating at least $350,000 of client’s funds by using $100,000 of the funds to make investments in their own names and directing the remaining $250,000 to their own personal bank accounts. In addition, several unauthorized withdrawals from the client’s account were made that totaled $93,000. Thus far, Peterson has a permanent suspension and the current charge is still pending.

Based on FINRA’s BrokerCheck report on Peterson, a complaint was filed on September 1, 2017 alleging that Peterson provided misleading information to investor clients during his employment at Morgan Stanley Smith Barney. In 2016, Peterson and his colleague James S. Polese were both charged with allegations relating to stealing upwards of $450,000 from one of their elderly clients. The allegations include misappropriating at least $350,000 of client’s funds by using $100,000 of the funds to make investments in their own names and directing the remaining $250,000 to their own personal bank accounts. In addition, several unauthorized withdrawals from the client’s account were made that totaled $93,000. Thus far, Peterson has a permanent suspension and the current charge is still pending.